Dear [buyer name]

The price of [main raw material in their product] has increased a lot recently, so we have to increase the price of your product to X.XX USD per piece. We are sorry for the inconvenience caused.

Best regards,

[Supplier name]

How did you react? Did you see it as a lame excuse from the manufacturer, trying to justify an increase of their margin? Sometimes it is true, but not always.

What to do?

First, collect some data. For example, on Steelhome.cn, you can see the prices of copper, aluminum, or nickel:

Second, is it fair to increase the price as suggested by the supplier? If the material price goes up by 20%, should the total product price also go up by 20%?

It depends on the percentage of that material in the final cost in your product.

For a forged metal part, metal consumption is the highest cost contributor, therefore a proportional increase makes sense.

However, I have seen situations where the metal only contributes about 50% of the final product cost, but the supplier requested a proportional increase. That makes no sense.

To deal with such situations, you need to know the raw material contribution on the final cost, from the start. If you don’t have this information, I would suggest to run a quick request for quotation (RFQ) with other suppliers to ensure your supplier is still competitive.

Third, should your product cost always increase?

Chinese suppliers are only requesting a change in price when the raw material price goes up. When the price is decreasing, they forget to mention it.. and, if you request a decrease in cost, you will probably be given excuses — typically, they have old inventory, the price is unchanged, and “honestly, we are are still losing money”.

This is the same as my second point. Get some visibility. Run a quick RFQ and check if your supplier is gouging you.

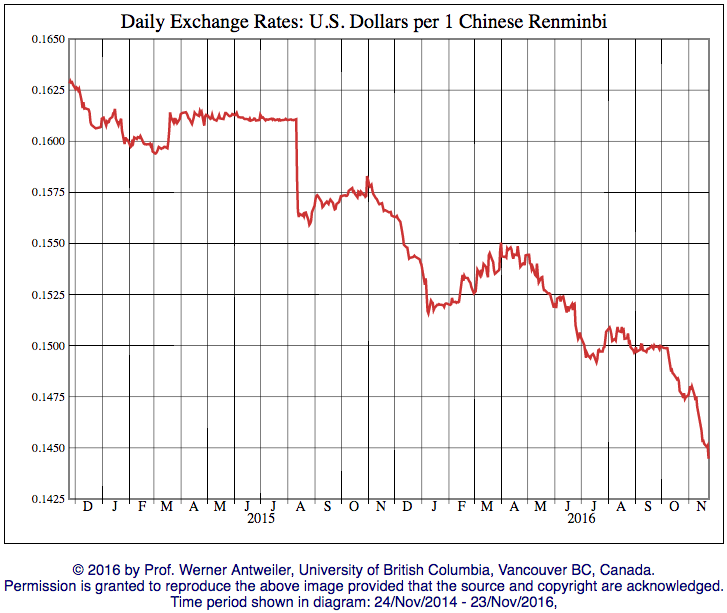

Fourth, what about the RMB (Chinese Yuan) exchange rate with USD?

The same mechanisms are at play here. You will virtually always benefit from indexing your prices on the RMB instead of the USD. RMB payments are more profitable in the long term (especially considering that that China’s currency has been depreciating continuously over the past few years).

As a summary, buying from China necessitates an understanding of the various factors that impact your supply chain. Raw material prices are critical and can have a significant impact on your operational margin. In addition to controlling your suppliers, you can take other measures such as pre-ordering raw materials to anticipate on an increase.

Mask

Mask